PECO is always in the market and shopping for new opportunities.

Aggressive Expansion Plans

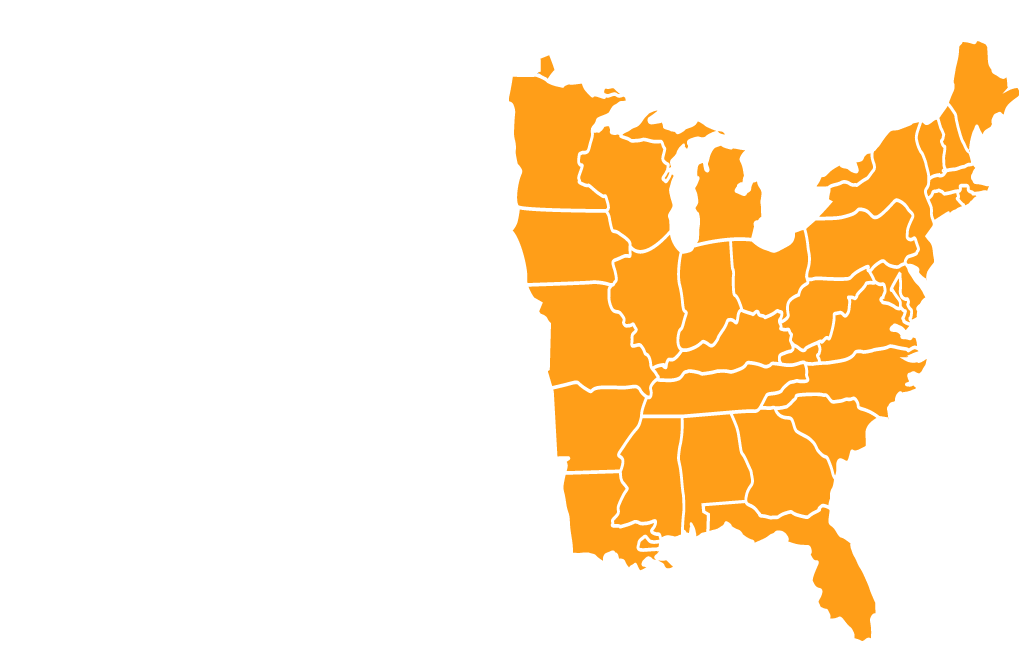

Phillips Edison's primary acquisition focus is grocery-anchored, necessity-based neighborhood and community shopping centers. Our nationwide portfolio includes more than 300 properties and we're in the market for more!

Our experienced team can overcome complex issues such as environmental concerns, high vacancy or deferred maintenance to make deals others can’t.

Acquisition Criteria

We are currently seeking opportunities to acquire core, core+ and value-add grocery-anchored centers nationwide.

- All cash, no financing contingencies

- Single properties or multi-property portfolios

- Will purchase assets or loans

- Exceptional record for closing in 30-45 days

Dispositions

We are currently offering select shopping centers for sale in markets across the country.

For more information regarding disposition opportunities, see the regional contact below.

National Acquisitions

David Wik

Senior Vice President of National Acquisitions and Dispositions

(513) 746-2557

dwik@phillipsedison.com

West

Nick Daffin

Vice President of Acquisitions and Dispositions

(513) 746-2557

ndaffin@phillipsedison.com

Our proprietary PECO Power Score® and Gold Score™ help us efficiently analyze and move on acquisition opportunities.

East

Navin Srinivasan

Vice President of Acquisitions and Dispositions

(513) 618-4443

nsrinivasan@phillipsedison.com